Legal Organization Name: Friends of the Hennepin County Library

Address: 300 Nicollet Mall, Ste. N-290, Minneapolis, MN 55401

Federal EIN #: 36-3579536

Friends of the Hennepin County Library is a registered 501(c)(3) organization. Donations are tax-deductible to the extent allowed by law. Please contact us when making a stock transfer and include the type and # of shares donated, so we can properly credit you with the gift and tax deduction.

Kerstin Beyer Lajuzan, Chief Development Officer

Friends of the Hennepin County Library

kbeyer@hclib.org

(612) 543-8106

Stock Transfer Information

To transfer stock to the Friends of the Hennepin County Library's account at US Bank:

Our US Bank contact: Brooke Degnan-Tupy, dial direct at (612) 303-2848

DTC Transfer number: 2803

For credit to the Friends of the Hennepin County Library account information please contact:

Linda Merritt, Finance Director

lkmerritt@hclib.org

(612) 543-8103

OR

Kerstin Beyer Lajuzan, Chief Development Officer

Friends of the Hennepin County Library

kbeyer@hclib.org

(612) 543-8106

Address

Charitable Services Group

US Bancorp Center

800 Nicollet Mall, Ste. 800

Minneapolis, MN 55402

Email

charitableservices@usbank.com and brooke.degnantupy@usbank.com

Wire Funds Information

To wire funds to the Friends of the Hennepin County Library's account at US Bank N.A.:

Our US Bank contact: Brooke Degnan-Tupy, dial direct at (612) 303-2848

For credit to the Friends of the Hennepin County Library account information please contact:

Linda Merritt, Finance Director

lkmerritt@hclib.org

(612) 543-8103

OR

Kerstin Beyer Lajuzan, Chief Development Officer

Friends of the Hennepin County Library

kbeyer@hclib.org

(612) 543-8106

Address

Charitable Services Group

US Bancorp Center

800 Nicollet Mall, Ste. 800

Minneapolis, MN 55402

Email

charitableservices@usbank.com and brooke.degnantupy@usbank.com

Charitable Stock Gifts

See combined tax savings of up to 70% of your gift when you donate appreciated stocks or mutual funds.

Donating appreciated assets avoids federal capital gains taxes and provides a federal income tax deduction for the current market value of the gift. Similar state tax benefits are also provided in most of the country.

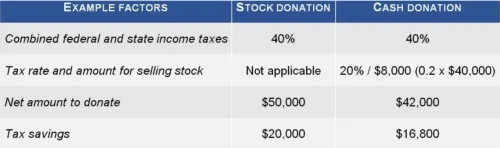

Donation Example

Suppose you can either (1) donate $50,000 in stock held more than one year, (2) sell the stock first and donate the proceeds. The stock has a cost basis of $10,000. You have a 40% combined federal and state tax rate on your income and a combined 20% tax rate on capital gains.

Have questions about making a stock donation? We’re happy to help!

Kerstin Beyer Lajuzan, Chief Development Officer

Friends of the Hennepin County Library

kbeyer@hclib.org

(612) 543-8106